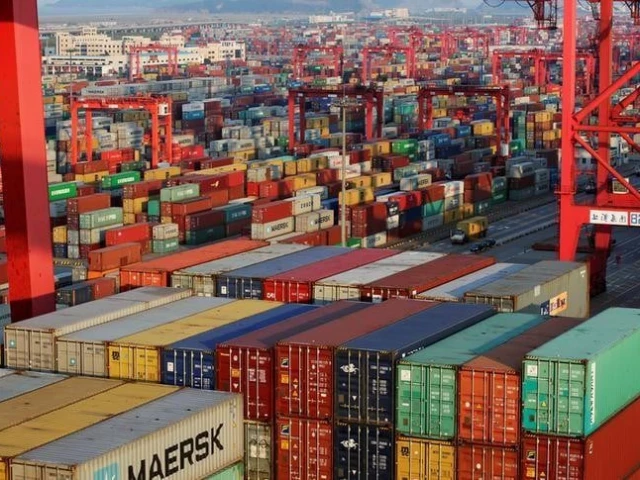

February’s GST revenue growth reflected the third-highest uptick in 2023-24 and lifted the total collections so far this year to ₹18.4 lakh crore. File

| Photo Credit: Reuters

India’s gross revenues from the Goods and Services Tax (GST) grew at a three-month high pace of 12.54% in February to cross ₹1.68 lakh crore, marking the fourth-highest monthly collections from the tax.

February’s GST revenue growth reflected the third highest uptick in 2023-24 and lifted the total collections so far this year to ₹18.4 lakh crore, 11.7% above the same period last year. The gross GST kitty of ₹1,68,337 crore in February was 3.3% lower than January’s updated collection numbers of ₹1,74,106 crore, the second-highest tally since GST was launched in July 2017.

The GST numbers “demonstrate continued growth momentum and positive performance”, the Finance Ministry asserted, noting that collections from domestic transactions rose 13.9%, while goods imports delivered a 8.5% rise in revenues.

State-wise data

After refunds, the Ministry pegged last month’s GST collection at ₹1.51 lakh crore, 13.6% over February 2023’s collections. Overall net GST revenues this year have grown at a sharper pace of 13% than gross revenues, and stand at ₹16.36 lakh crore.

Among the States, five recorded contractions in revenues in February, while 18 States clocked lower upticks than the national average growth of 13.9% in revenues from domestic transactions. Revenues dropped 14% and 13% for Mizoram and Manipur respectively, while Nagaland (-5%), Bihar, and Jharkhand (both -1%) reported milder declines.

Revenues grew faster than the national average in 12 States, including the erstwhile State of Jammu and Kashmir (23%), Assam (25%), Maharashtra (21%), Karnataka (19%), Telangana, and Punjab (18%), as well as Kerala and Delhi (up 16% each).

Compensation cess collections

February’s gross GST intake included ₹31,785 crore of Central GST (CGST), ₹39,615 crore of State GST (SGST) and ₹84,098 crore of Integrated GST or IGST, of which ₹38,593 crore was collected on imported goods. The GST compensation cess collections stood at ₹12,839 crore, with a little under a thousand crore rupees received on imported goods.

“The Central government settled ₹41,856 crore to CGST and ₹35,953 crore to SGST from the IGST collected. This translates to a total revenue of ₹73,641 crore for CGST and ₹75,569 crore for SGST after regular settlement,” the Ministry said in a statement.