Image for representation only.

| Photo Credit: Getty Images/iStockphoto

The Group of Ministers (GoM) on Rate Rationalisation, formed by the Goods and Services Tax (GST) Council, has decided to accept the Centre’s two-rate structure proposal for GST and will be recommending this to the GST Council, the chairperson of the GoM and Bihar Deputy Chief Minister Samrat Choudhary said on Thursday (August 21, 2025).

This was the first of two steps the proposals would need to clear before being implemented. The second step would be for the GST Council to accept the changes.

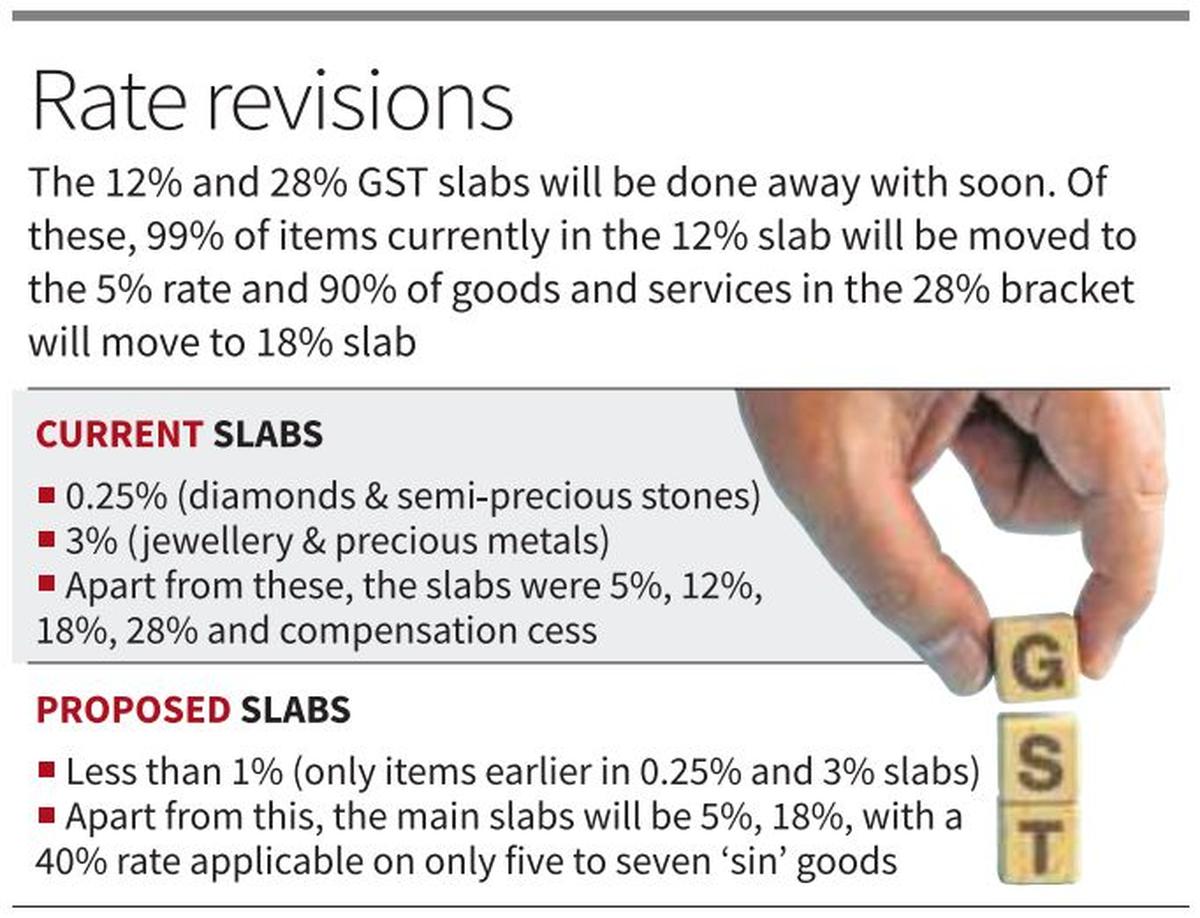

“It was the Centre’s proposal to end two slabs of GST, the 12% and 28% slabs,” Mr. Choudhary told reporters. “We discussed that proposal and have supported it. We have recommended it, and now the GST Council will decide on this.”

Also read: Required reforms: On reforms to the GST system

The Centre has not, however, announced the date for the next GST Council meeting, although it is expected in early September.

In his Independence Day speech, Prime Minister Narendra Modi announced that the “next-generation GST reforms” would be a “Deepavali gift” from the Centre. The reforms will bring down the “tax burden on the common man”, he added.

The Centre’s proposal involves retaining just the 5% and 18% slabs in the current GST structure and doing away with the 12% and 28% slabs. This would entail 99% of the items in the 12% slab moving to 5%, and 90% of the items in the 28% slab moving to 18%.

The remaining items in the 28% — comprising ‘sin’ goods and services such as tobacco, cigarettes, and online real-money gaming — would be moved to a higher 40% slab. However, the compensation cess currently being levied on the items in the 28% slab would no longer apply.

“The proposed shift of most items from 12% slab to 5% and from 28% slab to 18% promises tangible relief for households and MSMEs while aligning with the government’s broader agenda of growth and financial inclusion,” Manoj Mishra, Partner and Tax Controversy Management Leader at Grant Thornton Bharat said.

However, he also said that there needs to be “careful calibration” to preserve revenue neutrality and avoid inflationary pressures.

According to Saurabh Agarwal, Tax Partner at EY India, the Centre’s proposals are an acknowledgement of the importance of consumption to the Indian economy.

“This is a clear signal of confidence in India’s domestic consumer base as the primary engine of growth, especially amid global trade uncertainties,” Mr. Agarwal said. “By easing costs for households and enhancing affordability, this framework is poised to strengthen our consumption-driven economy.”

Published – August 21, 2025 03:07 pm IST