The owner of a small Aussie business has revealed she is still owed $42,000 by failed buy now pay later business Openpay, and that most of the debt relates to transactions the company entered into after it knew it was in financial trouble.

Tara Low, who owns online bulk foods business SnackEzy, contacted news.com.au after we broke the news that Openpay, once a major player in the buy now pay later market, had gone into voluntary liquidation at the end of last week.

Ms Low, 35, from Wollongong, said she is yet to see any of the money she is owed by Openpay, and that the debt may have pushed her into bankruptcy if extended family had not helped.

Know more? | michelle.bowes@news.com.au

Openpay was previously listed on the Australian Securities Exchange (ASX) and entered into receivership on February 4, 2023.

At the time of its collapse, it reportedly owed more than $66.1 million to creditors, $4.1 million in unpaid leave and wages to employees, and had just $1.2 million left as cash in the bank.

Ms Low told news.com.au that her suspicions about the business were first raised when it deviated from its normal merchant payment schedule.

She said the normal process for receiving payments from Openpay was that they would transfer funds to merchants the evening following the day of purchase.

For example, money from sales on SnackEzy using Openpay as the payment method on a Monday would be received in Ms Low’s bank account on Tuesday night.

She added that funds from sales transacted on Friday, Saturday and Sunday would be paid the following Monday night.

Ms Low said that first sign that things were beginning to go amiss was at the end of January – days before Openpay called for a trading halt on the ASX and more than a week before it announced it had appointed receivers.

She said that rather than the weekend’s takings, only the money from sales on Friday January 27 was deposited into her bank account on Monday January 30.

Instead, takings from sales made on Saturday January 28 were deposited on Tuesday January 31, takings from sales made on Sunday January 29 were deposited on Wednesday February 1.

And then the payments stopped altogether.

Despite inquiries to Openpay about the unusual payment schedule and missing payments, Ms Low said she was told that everything was fine and continued to accept sales using Openpay for the rest of that week.

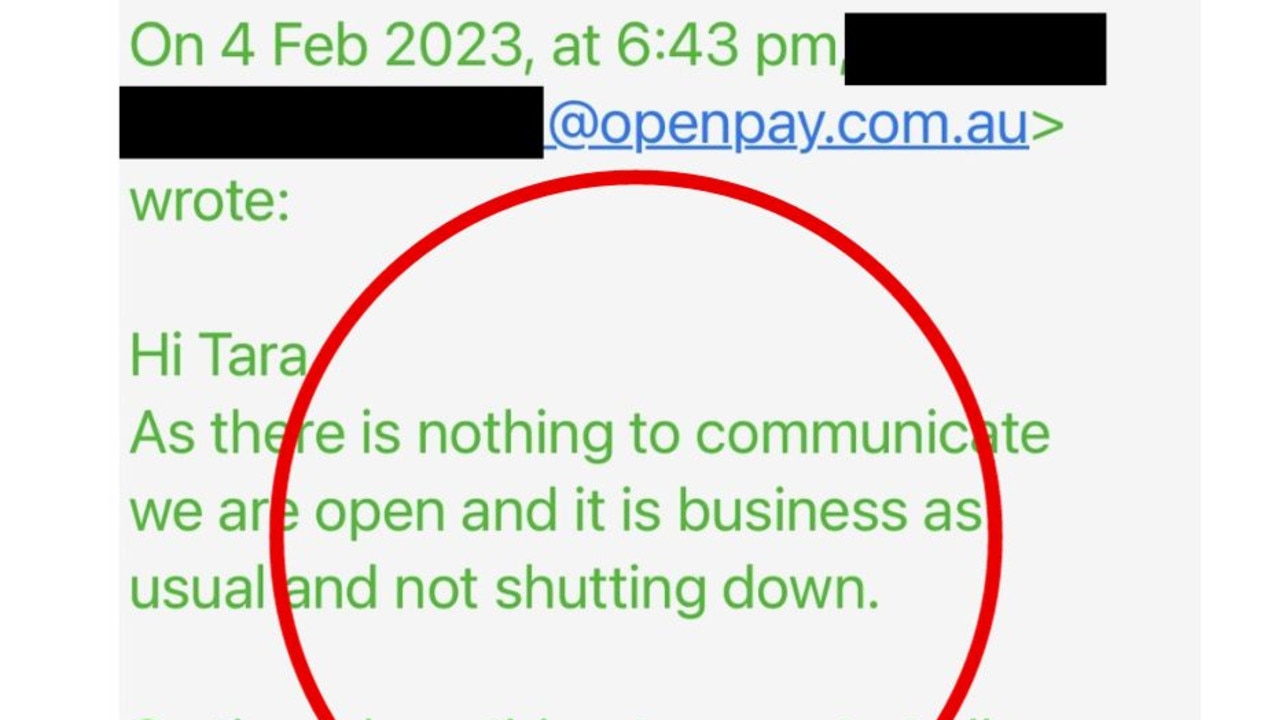

On Saturday February 4 she received an email from an Openpay business development manager which read: “As their [sic] is nothing to communicate we are open and it is business as usual and not shutting down. So there is nothing to report.”

But on Monday February 6, Openpay announced, via the ASX, that it had actually appointed receivers on Saturday February 4.

Ms Low said that she never received the money for any sales she made that were paid for using Openpay from Monday January 30 to Sunday February 5, which amounted to approximately $42,000.

She hit out at the firm for continuing to trade when it knew its financial position was precarious.

“If they knew they couldn’t pay me I could have stopped taking orders and would only be in the hole about $6,000,” she said.

Ms Low added that the timing of Openpay’s collapse coincided with one of the peak trading times for her business as it was the start of the new school year, a traditionally busy time as parents look to stock up on lunch box-friendly snack foods.

She said that following the news that the company had failed, she was locked out of its online merchant portal.

As a result, she told news.com.au that the $42,000 figure was an estimate and that the true amount she is owed could actually be higher.

Ms Low said that when she contacted the Openpay’s receiver, McGrath Nichol, she was told that she “wasn’t a big player” and that Openpay “owed so much money” to its financial backers that it was unlikely she would get any of the money she was owed.

She said she was told that if there were any funds to be recouped, Openpay’s financial backers would receive money first, followed by staff and major retailers who used the company such as Bunnings, Beaurepaires, Repco, Bupa Dental, Berlei, National Tiles and Kogan.

“I was told that the best case scenario would be if Openpay were bought out for a significant sum”, Ms Low said.

But even then, she was warned that the most she was likely to get back would be 5-10 cents for each dollar she was owed – or around $2,100 -$4,200, in perhaps 18 months time.

When a company fails, receivers are responsible for trying to recover money for secured creditors of the business.

McGrath Nicol sought expressions of interest from parties looking to purchase Openpay or recapitalise the business, but as no deals were able to be struck with buyers or investors, the company was put into liquidation, with Cathro & Partners appointed as liquidators on November 23.

Liquidators look to assess claims by unsecured creditors, like Ms Low, in the hopes of returning some money to them.

Cathro & Partners have not responded to requests from news.com.au for an interview and the size of Openpay’s remaining debts are unclear, however it is likely that other retailers and staff are still owed money.

According to a document filed with the Australian Securities and Investments Commission (ASIC) the liquidators will hold a creditor’s meeting on December 5.

“Openpay were a huge, trustworthy brand,” said Ms Low, who continues to offer a range of buy now pay later payment options to her customers from companies such as Afterpay, Zip, Humm and Klarna.

She said despite her experience with Openpay, she feels she has to continue to offer buy now pay later options as many of her customers are lower socio-economic families.

“We pay through the nose for them but we have to offer them,” she said.

“I just make sure every night money gets settled into my account.”

Know more? | michelle.bowes@news.com.au