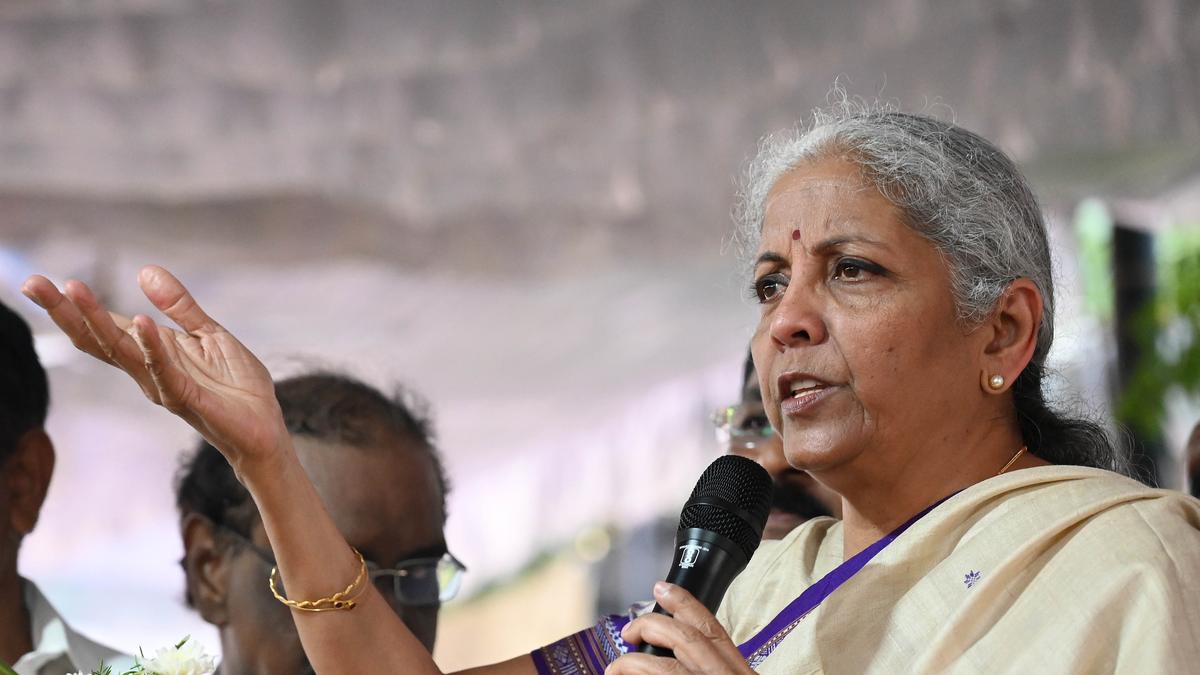

Finance Minister Nirmala Sitharaman. File.

| Photo Credit: Bijoy Ghosh

Finance Minister Nirmala Sitharaman on Wednesday (September 17) said that the GST reforms will bring ₹2 lakh crore into the hands of the common man.

Addressing a gathering in Visakhapatnam, Ms. Sitharaman added that the GST Council decision aims to reduce the tax burden on consumers and improve liquidity in the economy.

The Goods and Services Tax (GST) is the only tax applicable to every citizen of the country. Therefore, the Central Government has come up with new reforms in the name of GST 2.0 to further simplify the current complex GST system, she said.

Every tax on daily necessities has been rigorously reviewed and in many cases, the rates have been reduced significantly in the new GST 2.0, which will be effective from September 22, she said while addressing an outreach programme on next generation GST reforms held in Visakhapatnam on Wednesday (September 17).

Also read: Will the GST rate cuts boost the economy? | Explained

She said said that there will be only two slabs (5% and 18%) GST in the country under GST 2.0 hereafter (from September 22) instead of the five slabs (0%, 5%, 12%, 18%, and 28% ) in the existing system. It will be five per cent for common consumer goods and 18% for others. While specifically speaking, the GST reforms cut taxes on household essentials such as soaps, toothpaste to five per cent or nil boosting affordability. Live saving drugs such as medicines reduced from 12% to nil or five per cent. Two wheelers, cars, TVs and cement cut from 28% to 18% bringing relief to middle class.

The Union Minister further said that 99% of goods, which account for 12% GST, have come under the five per cent GST slab under the new system, which will benefit the middle class and the poor across the country.

“The welfare schemes, development of the infrastructure such as roads, airports, Vande Bharat trains all these things are because of the GST tax. The GST revenue has increased from ₹7.19 lakh crore in 2018 to ₹22.08 lakh crore in 2025. She said that the number of taxpayers who were 65 lakh earlier has increased to 1.51 crore,” Ms. Sitharaman said.

The Union Government is hoping that the new GST reforms will enable more spending, making things more affordable as more money will be left in the hands of the people of this country, she added.

Ms. Sitharaman reiterated that the new GST reform, which is the biggest since the One Nation – One Tax came into effect from July 1 in 2017, has been implemented with a focus on the common man.

Published – September 17, 2025 02:06 pm IST